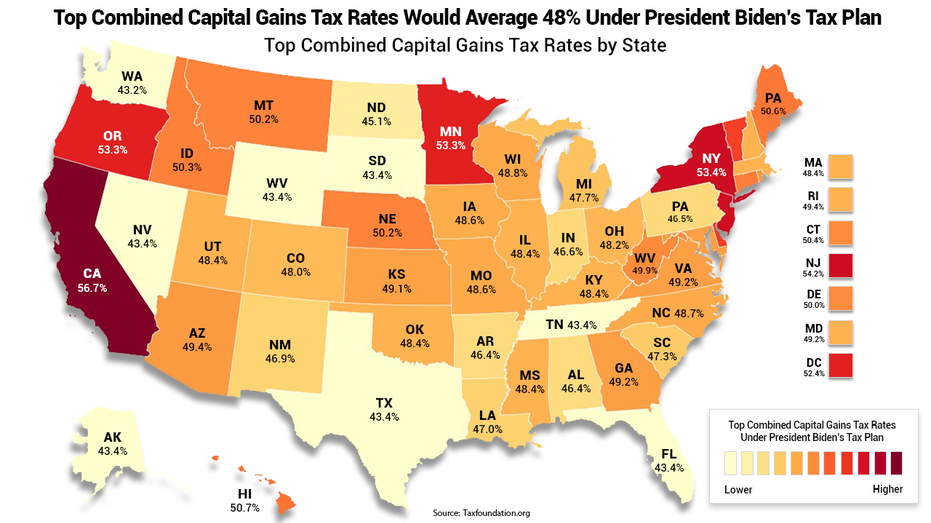

Biden's proposed capital gains tax hike might hit wealthy Americans with 57% rate, study shows | Fox Business

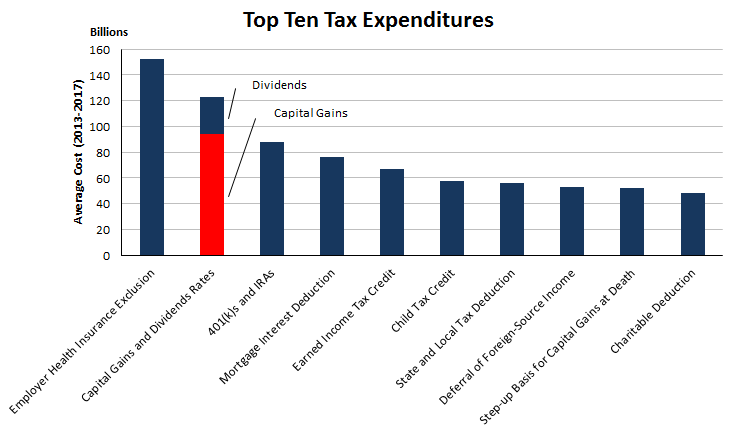

The Tax Break-Down: Preferential Rates on Capital Gains | Committee for a Responsible Federal Budget

The Tax Break-Down: Preferential Rates on Capital Gains | Committee for a Responsible Federal Budget

A programmer tries to figure out how capital gains tax ACTUALLY works. | by fpgaminer | HackerNoon.com | Medium

Top individual income tax rates on dividends, long-term capital gains,... | Download Scientific Diagram

U.S. Taxpayers Face the 6th Highest Top Marginal Capital Gains Tax Rate in the OECD | Tax Foundation

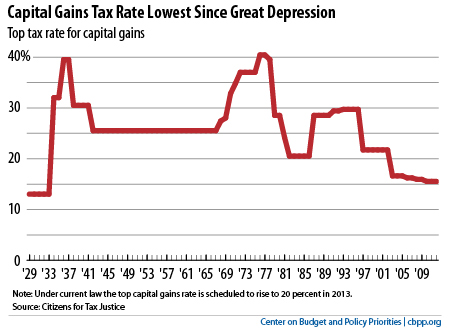

Chart Book: 10 Things You Need to Know About the Capital Gains Tax | Center on Budget and Policy Priorities

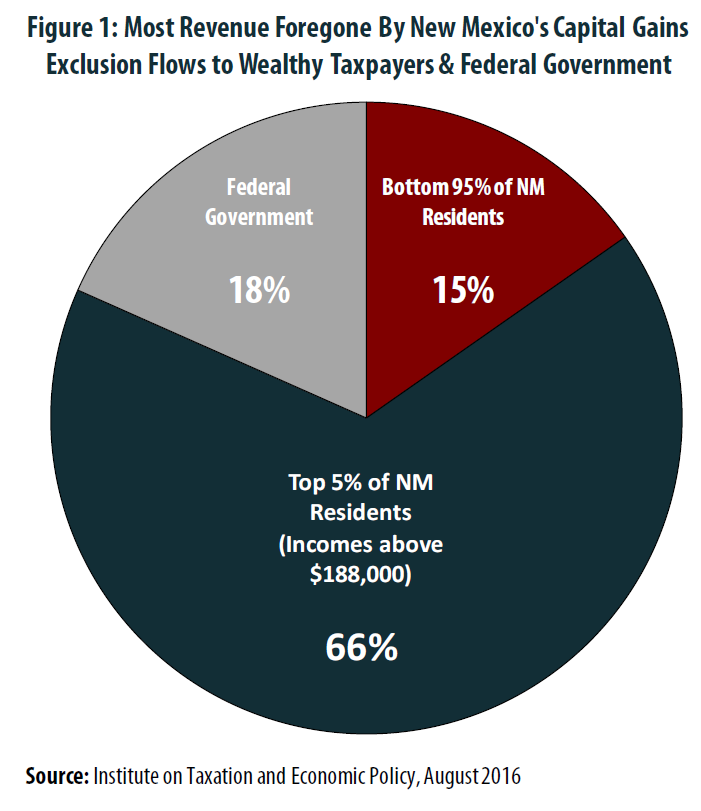

Ten Reasons to Reform the Tax Code: Reason #8 - Ten Reasons to Reform the Tax Code: Reason #8 - United States Joint Economic Committee

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)